Friday, December 28, 2007

A new twist

FLORIDA HANGAR USED AS MARIJUANA FARM

In rural Sarasota County, Florida, police have been on the lookout for "grow houses," secluded properties where barns and even homes are used as factories to grow large amounts of marijuana. This week, their investigations led to an airplane hangar at an 11-acre property in a

neighborhood with a private airstrip. The home and a hangar had been sold to new owners in February.

November/December Month's Inventory

Thursday, December 27, 2007

Holiday Cheer: What's your type?

I see homes falling into the following types, with my guess as to possible characteristics of the inhabitants as well:

- No decorations: too busy for stop and celebrate the holidays, away for the holidays, hermits, or possibly Grinch's who don't want to pay the higher electricity bills.

- Single color light string across eves and roof: Type A, likes everything in its place, or perhaps not Christian but interested in showing some holiday spirit.

- Many types of lights and no particular pattern: Pack rats, kids helping put up the lights.

- Lawn ornaments: People who like to collect things (stamps, baseball cards, china, dolls, cars, boats etc).

Where I grew up on the Central Coast, there were more homes decorated than not. Here in Serrano, we seem to be in the minority. My daughter is just old enough to enjoy all the decorations, so it anyone knows of some good streets around here....please let me know.

Wednesday, December 26, 2007

Looking for Signs

I've been reading Contrarian Investing by Anthony Gallea and William Patalon. For those unfamiliar with the concept of contrarian investing, the idea is to buy when others are selling (at market troughs), and sell when others are buying (at market peaks). (It is one of the strategies utilized by Warren Buffett in his investment decisions.) One of the principles of contrarian investing requires the identification of market peaks or market bottoms, by sometimes subjective evidence. For example, when the likes of supermodel Gisele Bundchen demands to be paid in Euros and not dollars because of the declining dollar, this is an indication that its time to buy dollars and sell Euros, because the dollar has reached a bottom. Another measure of a market reversal is when the most bullish of bulls in the market, capitulates and admits the market is going south.

So the question came to me, "What will signal capitulation and the bottom of the decline in real estate prices?"

Saturday's Wall Street Journal gave me the answer. In a page 2 story talking about real estate price indexes and the scheduled December 26th release of the latest Case Shiller home price index, the writer mentioned the forthcoming NAR release of existing home sales data on December 31st. While not rendering a prediction as to the actual content of the December 31st NAR release, the author opined, "One prediction is safe: The Realtors will see signs of hope on the horizon."

Which, of course, led me to the answer of what will signal the bottom of the decline in real estate prices. When the NAR stops telling us "there has never been a better time to buy real estate" or "real estate is picking up," I will know that we are at the market bottom!

Thursday, December 20, 2007

The Weekly Screen Scrape - Pulse Check

Hopefully Sac Bee will post the DQ numbers soon.

Happy Holidays to all........

Wednesday, December 19, 2007

Help for the Holidays

I am without my WSJ this week, and don't have any spare time to formulate new ideas (well except for when sitting in the ridiculous traffic here!).

Please e-mail to average_buyer@yahoo.com

Monday, December 17, 2007

Global Insight/National City Q3 2007 Home Valuation Data

I am not sure I completely agree with their assessment. Likely because they account for interest rates, so perhaps with low interest rates, it makes their overall valuations look better at higher median prices. Excerpt on what their study covers:

"Our approach to determining statistically normal house values1 considers not only house prices and interest rates, but household incomes, population densities and any historical premiums or discounts metropolitan areas have exhibited over time."

Don't know exactly when this was released...usually it makes the news...just happened to stumble on it when showing a friend in D.C. the stats. Apparently declining home value studies don't even make the major news outlets anymore!

Friday, December 14, 2007

Strategies for Living within your Means

In many ways we are a very average family: 2 kids, 2 jobs, 2 political parties. But I am beginning to think we are not so average because we actually live within our means. My personal strategies include:

- 30 year fixed interest loan (or shorter…we refinanced our first home into a 20 year loan when the rates dropped).

- Pay off credit cards every month.

- Put away the maximum in 401ks each month.

- Check my receipts (especially the grocery store) for mistakes. I tend to find at least one every other week.

- Count my change. Its amazing how often people give you the wrong change. And being the honest gal that I am, I give back the money if they make the mistake in my favor.

- Keep our books. I use Quicken and update it every 3 months to keep a fairly updated picture of our financial situation (I did it more often before kids…but making the time is tough these days).

- Don’t sweat the small stuff. I try and keep saving money in perspective. Its not worth driving 10 miles to a cheaper grocery store to save $4. The time and gas isn’t worth it. It is worth shopping interest rates for your car and mortgage payment, your two biggest monthly expenses. (Most of us don’t have much choice when it comes to health care so that doesn’t make the list.)

- Time is money. As a working mom, my free time is valuable, so I tend to shop at places where they have good prices on average (Costco, Target). For me, getting a great deal on one item out of the 20 that you need isn’t worth an extra trip. I would rather go to one store and buy all the items I need and reasonably low prices than shop the sales (I liken it to dollar cost averaging).

- Payoff you student loans before saving for your kids education.

- No expensive personal care. No $100 highlights, no massages, no facials, no manicures or pedicures (I dont' even know how much these things cost, but I know they aren't cheap, especially if you do it every month). But we don't skimp on health related items. We belong to a gym and get flu shots. If you don't have your health, its hard to enjoy your wealth =)

- Know where quality counts. The quality of an item I purchase depends largely on how often and how intensely I will use a product. For example, my wedding dress was only $200 (including some extras)…..after all, you only wear it for a couple of hours. But I don’t mind spending $$$ on a quality pair of shoes I will wear twice a week.

- Try not to eat out more than once a week.

- Don't forget to splurge every once in a while (we do on our date night).

I'm sure there are many more...but so much of this is unconscious behavior. I have been doing it so long, I don't even notice it much anymore. Other suggestions are welcome......

Do I feel sorry for educated folks (especially second time buyers) who bought into a lifestyle instead of their budget, or didn’t read their mortgage documents? Not really. Your home is by far the biggest purchase you will ever make. While I can understand not reading the terms of use for a software product, or the privacy policy on a website, I can’t understand how people can be so negligent about mortgage papers. I find this situation strangely similar to one occurring in the financial world. (Special thanks to Paul for the following write up):

“There is a parade of banks and other financial institutions in the news taking financial write-downs. In each instance, they have reported that there may be more write-downs in the future because they are not able to accurately value the subprime loans and CDO's in their portfolios. In other words, the banks and financial institutions have huge exposure to investments that even they do not understand and cannot value. If these so-called investments are so difficult to understand and value, what were they thinking when they bought them?”

Thursday, December 13, 2007

The Weekly Screen Scrape - Home for the Holidays

Second, contract activity is up significantly, perhaps in response the some of the huge price cuts I saw last week.

Hoping SacBee will post their Dataquick stats tomorrow, as I head out to D.C. next week and won't have much time for my RE obsession.

A little schadenfreude

They are now listed at $399,000 (down from $439,000)! And in my opinion, still have a long way to go.

Mr. BT might get annoyed with me....but I will post details on this one. Its not a secret, that we have been looking at homes that back to the American River, south of 50 (I rented a room on Twin Falls out of college, and loved it). This home is one of the few 4 bedroom 2000 sqft+ homes in the area. From the drive by, it looked well maintained. But now we know why they don't have more pictures......really bad add on and poorly done DIY upgrades.

MLS 70108202

Wednesday, December 12, 2007

Where is the mortgage insurance in this mess?

I wonder if there has been an increase in claims? I don't seem to hear much about it, except for some excerpts that the insurers started refusing to do business with some lenders. If a person takes out an equity line of credit, can the 1st lien holder then require them to pay mortgage insurance, if the borrower no longer has 20% equity?

I'm sure this has been covered somewhere....but I don't read the national housing blogs. Anyone know of a link that covers this subject?

Marketing tip of the day: If the home is worth 520k - 530k, then price your home at $521,000, which is $417,000 plus 20% down so the buyer doesn't have to take out a jumbo loan.

Midtown Sacramento Historical Data

Not sure how much I buy the "land scarcity" leads to appreciation argument, as nice suburbs tend to hold up better in many metro areas, and blighted inner cities neighborhoods tend to stay that way.

I think the land scarcity is one small piece of the puzzle. Home values are highly dependent on many factors. Hence East Sac does better than West Sac, even though they are somewhat equidistant to downtown. There is a lot more in play than just the land.

Tuesday, December 11, 2007

Can't Stop the Bleeding

I call this the bleed slowly strategy. Many owners would much rather bleed $500 a month below carrying costs, than sell for $10,000-$100,000 less than it would have fetched in 2005.

Now if I had paid more attention in finance class, I would have been able to present a nice options model to value these two choices over time with market condition assumptions. Instead I have just prepared some simple numbers to show how costly the bleed slowly strategy is in a down market.

If someone rents out their home for a $500 monthly loss, that's $6,000 a year they are in the hole. However, if you add onto that, the longer they wait to sell, the more their home will have depreciated from its peak value....its a double whammy.

If they decide to "wait till the market comes back," then they have tied up their cash for 10 plus years. Thus they still have the opportunity cost of the cash (foregone investment returns elsewhere) they put into the deal, as well as the loss they have taken on the rent.

December Change in Inventory By Zip Code

Depressing technical note: Typically I name my graphics by the month and type of graph. I have started adding the year, as it seems I may be at this for longer than I planned.

Inventory was gathered from ZipRealty for single family homes on the date indicated.

Monday, December 10, 2007

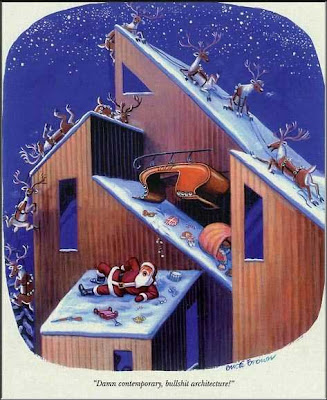

The Problem with Modern Architecture

Sunday, December 9, 2007

Sacramento Schools that Make the Grade

Silver

Oak Ridge, High El Dorado County, El Dorado Hills, CA

Ponderosa High, El Dorado County, Shingle Springs, CA

Rocklin High, Placer County, Rocklin, CA

West Campus, Sacramento County, Sacramento, CA

Davis Senior High, Yolo County, Davis, CA

Folsom High, Sacramento County, Folsom, CA

Bronze

Galt High, Sacramento County, Galt, CA

Natomas Charter #19, Sacramento County, Sacramento, CA

County Special Education, Sacramento County, Mather, CA

I don't know much about Granite Bay, but from what I have heard, I was surprised they didn't show up in the rankings. A methodology issue perhaps?

As discussed earlier many of the best schools are in the least affordable areas.

Friday, December 7, 2007

Lack of Affordability in Sacramento

"Median household income in the Sacramento metropolitan area, measured earlier in 2007 by the American Communities Survey, is $56,950. Realistically, if you don’t want to spend more than 33% of your take-home pay on a mortgage and you earn the median, you should pay no more than about $1,570 towards your mortgage and taxes. That caps your mortgage loan at $240,000 (which still leaves you a modest $150 a month to put toward taxes) at a 5.85% interest rate (this week’s going rate for a 30-year fixed). But the median single-family home price in the third quarter was $375,400 in Sacramento. That’s a $135,000 gap. What’s more, the median income to sales price ratio balloons to 6.6 in this equation. There’s nothing affordable about that.

You’d need to have a median income of at least $70,000 — or nearly 25% more than the median — and a 20% down payment to buy the same home in the Sacramento area. This situation plays out in dozens of pockets of the country every day, even as housing prices soften."

Sample Contract Language

"Buyer is concurrently making offers to purchase other real property. This offer is only one of the offers being made by Buyer. Notwithstanding the submission of multiple offers, Buyer intends to only purchase one property at this time. Therefore, Buyer’s receipt of a duly signed acceptance of another offer before Buyer personally (not Buyer’s agent, if any) receives Seller’s written Acceptance of this offer, shall be deemed as a withdrawal of this offer and Buyer’s deposit will be returned to Buyer. In such event, Buyer will attempt to inform Seller of said withdrawal as soon as reasonably practicable."

Thursday, December 6, 2007

Average Buyer is Moving!!!!

No…..A much worse fate in fact. I am making the much dreaded move into an older demographic group.

This week I transition from the young hip coveted 25-34 year old demographic, into the scorned and stodgy 35-55 group. According to our youth obsessed culture, this is a sad time for me. At least I will get a nice sushi dinner out of it.

However Big n Rich just reminded me of the upside of this move, I qualify to run for president now!

_________________

In case I am being too coy, this isn’t meant to offend anyone….its meant to be a social commentary on how marketing executives covet the younger demographic when it’s the 35-55 year olds (and up) with the disposable income.

For example, I went to Sunrise Mall, and couldn’t find a place to buy clothes. The only two choices seem to be teeny bopper shops and matronly department stores. I desperately wanted to get some new clothes, but couldn't find any place to shop. I left without purchasing a thing.

Perverse Incentives

The Weekly Screen Scrape - Holiday Discounts

Seems whenever I start to get really discouraged that prices are starting to bottom out in 95762 & 95630, I see some nice movement. Thanks Santa!

Wednesday, December 5, 2007

Help Me be a Better Bargainer

The best negotiating tactic, given my personality inclinations, is to play the innocent intellectual role, using data as my weapon of choice (I really love it, but I can't figure out why its priced 10% over comps). Hence the only suggestion I have been able to offer is to use publicly reported builder data as a basis for negotiations.

Yes I have time and a relatively low rent payment on my side….but becasue I don't bargain well, it just means I am likely to walk away, as opposed to trying to negotiate a better price or contract terms for the house I want.

All this to say, I would love to gather input on tactics that have worked for others. I will compile suggestions and put them in a separate post on the sidebar since I know many of you are finding homes that are now within range.

For example, a previous commenter suggested changing the standard contract text to allow the buyer to make multiple contingent offers, which I thought was pretty brilliant because it prevented sellers from shopping the offer.

Tuesday, December 4, 2007

If your Average Buyer could Legislate

Below are my suggestions for addressing (notice I didn’t use the word “fixing”) the housing mess. Many of these good ideas have come from commenters….I am merely trying to put them all together in a framework. Of course the best solution for us buyers is to let the market fully correct so that housing is affordable once again, but at least right now, that option is not on the table politically.

How to address the current situation:

1) Exempt first time homebuyers from the tax hit if they sell at a loss. If they end up foreclosing, give them a “free walk on their credit”. More flexibility should be given to first time homebuyers in terms of negotiating rate freezes and longer loan periods. A little more on the rationale behind this can be found here and here. We should not try and keep people in homes unless it actually makes financial sense to do so (financial sense for the borrowers, not the investors).

2) Second time home buyers, should only be eligible for loan period extensions since, in theory, they have a better understanding of the process and cannot claim ingnorance.

3) If a person took out a Home Equity Line of Credit on their house over $5000, (or refinanced for a larger balance) for anything other than vital home repairs (a leaky roof, or broken water heater) or other documented emergency (medical or funeral bills) they should not qualify.

4) Any Realtors or Mortgage industry folks, not allowed to qualify since they cannot claim ignorance.

5) Investors or persons with more than one home are not allowed to qualify as they are not losing their primary residence, or if they are, they have another home they can sell to make the payments on their current home.

How to prevent this from happening again:

1) Get rid of all the fancy mortgage products (not sure how to do this exactly). Or at least require the borrower be shown a worksheet of their income and how the fully loaded monthly payment (taxes, principal, interest, and insurance) compares at both the teaser rate and the reset rate. This documentation should clearly list out any fees and penalties associated with the mortgage product such as prepayment penalties. Have HUD collect statistics and create a web page, where buyers can enter their closing costs and financing terms. The website will compare their individual data to national, state, and local trends to see how their loan product stacks up.

2) Require borrowers to be sent all mortgage related documentation 2 weeks in advance. (I hated how closing is scheduled for 1 hour, and they make you sign all these docs you are seeing for the first time that are several pages long…Its obvious they don’t want you to actually read them. We had requested them in advance).

3) Restructure compensation so that RE professionals, like Agents and Mortagage brokers are not commission based (only fee for service) to help avoid conflict of interest as well as brokers peddling products they get higher fees for. I was once told that there is actual legislation related to Realtor commissions which is why they are so hard to get rid of.

________________________________

Separately, but related from the Washington Post (emphasis is mine)

“Until now, President Bush favored government restraint. But with investors losing millions as Wall Street banks write down billions of dollars in bad home-loan investments amid mounting concerns about economic stability, the White House is pressuring the mortgage industry to offer a sweeping fix for the problem.”

Commentary: I see, so he’s getting involved to save the investors. I guess those pesky homeowners are threatening his economy.

Monday, December 3, 2007

Record Lows - MelissaData for November

Sunday, December 2, 2007

We're selling homes!!!

Up until yesterday, that safety home was in the new Blackstone development in EDH. With incentives the Lennar homes were priced well under resales and I could justify the outrageous HOA & Mello-Roos with comparisons to gym fees and the solar energy discount.

Bit of background.....bit of rant.

When we first visited the development shortly after opening (mid summer), we initially spoke with Peter (he was very condescending with us). After that experience we were pretty turned off. The homes were at least 50K over priced.

But decided to check back a couple months later since we were in the neighborhood, which was when we met Patti, who seemed much more open and honest, and was really trying to help us find a place we liked. We were glad we checked back cause the list price had taken a haircut of around 20K - 50K (in just 2 or so months of opening).

So I had stopped in on Friday talk to Patti again and see if they had any year end specials going. But she was gone and Peter wouldn't give out any details. He remembered us, not sure if it was from the initial visit or not. He insisted several time that they were selling houses, and then asked my price range. I replied under 500k. He then motioned to the list prices, basically telling me there wasn't much that fits that description (they do have a couple list under 500k). I left, rather disgusted.

Did he really have to do that? Who the hell believes that the list price is actually what they are selling for? I think they might have sold 2-3 homes a month since they opened....that doesn't seem like much to me. But perhaps its enough so jerks like Peter feel free to treat folks as if they aren't worthy of living in his development. So that is why Lennar at Blackstone has been removed from my safety list.

There are now some nice resales, under 500k going in the 150s a square foot around here. They are a bit bigger than we are looking for, but seems the mid sized homes aren't budging as much in price. So I am off to find a new safety house.

Update: So about an hour and a half after this posted, I got a call from...wait for it.......Peter! Very suspicious timing if you ask me. Not going to post the details of the call, till we make a decision either way......cause its tempting. Quite a bit bigger than we were looking for...but I have gotten rather used to our rental that's about the same size.

Saturday, December 1, 2007

December Good Buys & Offers to Sellers/Builders

Pieces of data to include: Zip Code, MLS or Development Name, List Price, Incentives, Offer (if any), house details (sq ft, garage size, lots size etc).

Feel free to post info for homes anywhere in the Sacramento Metro area. Just cause I tend to confine my search to the Gold River, Folsom, El Dorado Hills, Cameron Park areas doesn't mean others have to.