Monday, April 30, 2007

A (not-so-troubling) Trend

However, last I checked, 3 places actually came back out of escrow!! That's right, more houses are falling out of escrow than going in this week. It gives a whole new meaning to negative numbers!

As for the rate houses are going under contract....it has declined significantly since I began tracking (starting the first week in February). In early Feb the "Pending Sale" to "Available" ratio was around 35% (so approximately 1 in 3 houses on metrolist was PS). Now it is down to 20%. That's a 15% drop in only 3 months! The reduction is a combination of both increased inventory and a reduction in contracts.

Just a caveat, these numbers are only for the stats I track. Its a relatively small sample size, between 60-80 houses.

Saturday, April 28, 2007

A Look at the Trends in El Dorado Hills

The chart below has historical data EDH from two separate sources, DataQuick (via SacBee) and MelissaData. For more details on the problems with the data see the earlier post.

See updated charts (http://averagebuyer.blogspot.com/2007/05/updated-folsom-and-edh-charts.html)

As with Folsom, the drop in sales in EDH is rather pronounced (fuchsia), but the $ seems to be holding on (dark blue). (MelissaData has average sales price and DataQuick is average price per sq foot.) The scale for sales is the same on both charts and all data includes a quarterly trend line to smooth out the noise.

Friday, April 27, 2007

Sale Price Inflation - Subsidized Housing

The main problem with subsidies:

1) They inflate the sales prices of the home. Median reported data and sites like Zillow show houses selling for much more than they actually sold for. This inflation makes it look like the market is doing much better than it really is. And to the best of my knowledge buyers don't receive this information!

2) Realtor gets paid a percentage on final price of the house which includes the subsidy. So we ended up paying our realtor $240 more in commission! (2%)

3) If sellers don't realize their neighbors sales price included a hefty subsidy, it decreases their flexibility, exacerbating the already big gap between buyer and seller expectations.

I have a strong feeling there is a lot of subsidization occurring in the markets I am looking at. I asked a realtor if that information was reported (the way it is in Virginia), and she didn't even know what I was talking about (granted she is recently licensed).

Note: When we countered the initial offer with less subsidy, to bring up our net price, the buyer countered with a higher total sale price, but the same subsidy (in order to meet our net price).

Thursday, April 26, 2007

The Weekly Screen Scrape - How it all began

Once we were finally settled in after the big move, we started to look for a place to call our own. Back then the WSJ and the rest of the media were calling a bottom. Apparently I already had the heart of a bubble-blogger ....cause I didn't think we were anywhere near the bottom. So hubby and I made a deal.

Each week, I would pull all the MLS listings within our criteria to monitor market activity. If activity really seemed to be picking up for a sustained period (2-3 months), then we would jump in (the rate houses are selling compared to the rate they are coming on the market). I started the first week in February, so I now have data for almost 3 months.

This weeks results are the best yet!!!

Lots more inventory. Of the houses for sale, the price per sq foot has been slowly but steadily dropping. There are now some decent looking properties under $200 sq ft. (not just the major fixers).

As I failed to mention in my main post on new places.....the new houses are really putting the pressure on the resales around here......for example, this week, of the 2 developer listings that come up with our criteria, a new sale accounted for one of the two houses that went into escrow this week.

Wednesday, April 25, 2007

Wall Street Journal's favorite example of what's wrong with the housing market

Now I am a huge fan (I just stay away from all the fancy financial stuff as well as the editorial pages). Lots of data, good insights, and really on top of trends.

I have noticed Sacramento seems to make the WSJ on a monthly, and sometimes weekly basis, as the poster child for what is wrong with the housing market. We made the paper again today, with a 22% increase in inventory, prices on the way down, and of course all the loans going sour (page D1).

All this to say, if the WSJ, which I highly respect, thinks Sacramento is hurting......well then, I am just going to keep my down payment in the bank and earn some interest until I see signs of life in the housing market (and I am sure the WSJ will let me know when that time has come =)

Is the whole neighborhood for sale?

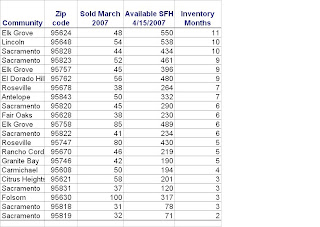

There are a lot of for sale signs cluttering folks yards in some of the places we have looked, and in others they are rare. So I did a little checking to see what the total turnover rates look like in various parts of the greater Sacramento area. On average for the zips I looked at, the rates are pretty high, one in 20 houses sold in 2006. That seems like a lot of churn to me....and 2006 was a slow year! (see last column in chart below)

I also looked to see how the churn compared to the for sale to inventory ratio. Highly correlated by my calculations, .8 (1 is completely correlated, and 0 is not correlated). Which means in general these neighborhoods have a more transient population.

Data sources: SacBees DataQuick from March 2007 and all of 2006 Sales (resales). For sale numbers from ZipRealty (thanks Gwenster). The total housing inventory came from LA Times via DataQuick (thanks sittin this one out). The LA Times only posted total inventories for zips with over 30 NODs, they were reporting NODs as a percentage of total inventory. There are some notable zips missing from this chart, like Roseville, Lincoln, Granite Bay, Rocklin and Davis (which is probably a good thing!). The chart is ordered by the for sale compared to total inventory.

Tuesday, April 24, 2007

A Look at the Trends in Folsom

See updated charts (http://averagebuyer.blogspot.com/2007/05/updated-folsom-and-edh-charts.html)

Monday, April 23, 2007

All Real Estate is Local

There are some huge disparities here. While I know today is better for the buyer compared to several years ago, many of the zips where we would consider living are still rather tight on inventory.

Riverfront Property in Sacramento

The dream of being back on the river never fades, so the whole family took a walk along the levy this weekend. The places on the South side of the American are steal for property with a nice clean river outside your backyard. But they don’t appear to come up for sale very often.

Pros: The price is right for river front property. According to Zillow, there does not seem to be a price differential between the houses that back onto the river, and the ones across the street. You can go fishing out your backyard before work in the morning. You have a fantastic walking path out your backyard. The American River is clean and the levy appears to be in good shape (unlike what I remember of the Sacramento River).

Cons: You get some weirdoes along the path, which concerns me a bit with two small kids. In addition everyone can see in your/yard house if they walk along the levy, in other words, minimal privacy. The Lucky’s grocery store that was there when I lived in the area is now a Big Lots….not a good sign. As with many of the more established neighborhoods in Sacramento, the public schools don’t appear to be very noteworthy.

Thursday, April 19, 2007

Age before Beauty

The per sq foot price of the new places we have looked at in Folsom are really reasonable compared to some of the resale (specifically, John Laing, and Elliott). The big kicker is that the new places are all on really small lots. And like most men, my husband has this hang up with having property......

Side note: I think the "big lot" syndrome, as I call it, its a left over evolutionary trait that all men crave large parcels of land (more grounds for hunting etc.).

In all honesty if it weren't for the "big lot" issue we probably would be buying a new place. You get to pick out what you want in terms of the interior design, and there is no laundry list of things to fix up when you move in. When you factor in the age and condition, new places are actually cheaper than the re-sales. The big caveat of course is the HOA/Mello Roos taxes, which tend to run around $150 a month (which by my crude calculations could have bought you another $50,000 of house). Another plus is there does not have to be a Real Estate agent involved!

Of course if I came to this conclusion, so have others. I don't know where to find data, but I imagine the new places are selling much better than the comparable resales. For them, the "time is money" holds true much more than for some of these folks who won't lower their asking prices.

Finding a Cure

The graphic below, of the median home price in Sacramento, is very intimidating. In fact it looks down right precipitous.

However, there has been a lot of speculation that the housing boom was fueled by cheap and accessible money. So I looked at the numbers in terms of the out of pocket expenses for home buyers. What is the monthly mortgage payment? Because in reality that is what people are signing up for.

Looking at the monthly payment its not nearly as scary as it seems (interest rate and points were national yearly averages based on data from Freddie Mac). In fact we have not even surpassed an earlier peak that occurred in 1981. Interesting, if you add a trend line....it is completely flat! Rather fascinating....I am sure there is a good explanation for it....but I can't think of what it would be other than the Alan Greenspan factor...

While this data only goes to 2005, it does tell me that once we get to interest and inflation rate adjusted 2002 levels then we are in reasonable territory (at the historical average). So now I sit impatiently waiting for my cure.

Tuesday, April 17, 2007

Peaks and Valleys - Half Way There

So how much do these markets have to fall before they get back to reasonable levels? Hard to say exactly. But if you assume that August 2002 was a reasonable level, you can estimate an average growth rate (I used generous 4%) and compare to the peak listed above.

This calculation yields a 39% drop from peak in Folsom and a 41% drop in EDH. Considering we are already at 19% for EDH, we are almost half way there!

Calculations were all based on the SacBee resale single family home data (originally obtained from DataQuick Information Systems) going back to August 2002 for Folsom and EDH.

Monday, April 16, 2007

Market Outlook - Folsom & EDH

EDH is another story. EDH has approximately 9 months of inventory and houses seem to sit here forever. We have been here for 6 months and haven't seen a whole lot of movement. There are lots of houses being taken off the market because sellers can't get what they want, and being converted to rentals. I suppose it is better to bleed slowly and face an uncertain fate than to take a bullet to the head.

EDH is overbuilt and overhyped (at least Serrano...the older parts are rather charming). There are way too many investors here looking for a quick buck. Take our landlord for instance that owns our place and one 2 doors down. Couldn't sell either of them for he price he wanted....and is now renting.

I have heard the "bay-area" theory which suggests that housing prices are being run up by transplants. Otherwise I can't explain where all the money is coming from. My personal prediction, is that yes there is some bay-area effect, but I think people got in over their heads and used fancy mortgage products to do it (like ARMs). Its easy for me to say now...but I had been saying this back in the fall before the big subprime blowout.

Summary - So for now, I think the less desirable neighborhood and overbuilt ones will suffer the most.....but soon, as financing woes come to head, it will start to take down more and more stable areas like Folsom.

Cold Feet

1) We would like to take our time and see what's out there. We were rushed into our first purchase because the market was soo hot (average places under contract within hours) we didn't have time for due diligence.

2) This is a HUGE amount of money we are talking.....so I get cold feet every time I think about committing to such a big debt burden. I have problems with the fact that 4 years ago I could have bought a house for half the price. I don't see how the market can sustain such price levels.....where are people getting the money from? Or is it paper money that will vanish? We earn a lot more than our parents and still can't afford anything too spectacular. Where did the American Dream go?

3) While we are not necessarily trying to time the market.....I don't want to watch my entire down payment evaporate. While technically we earned it in the housing market boom...it doesn't mean I am willing to part with it in the housing market either.

Truth in Lending

Second Time Buyer - We just moved out of our first home when we left D.C.

Family Size - Slightly Below Average (hubby, two kids...not pets)

Education Level - Above Average

Family Income - Above Average

Risk Tolerance - Below Average (both hubby and I come from very humble origins, putting ourselves through college etc. So we work hard and play by the rules. Risk is for those who can afford it....until recently were were still paying off enourmous student loans.)

Neighborhood Requirements - Average (Looking for established neighborhood in an nice middle class area. Don't feel combortable in wealthy parts of EDH, but don't want to end up sending my kids to private school.)

Impatiently waiting

We were amazed at how much rental house you could get....so we went a bit overboard. I was planning to work at home so I didn't want to feel too claustrophobic....and we have two young children as well as lots of family and friends we wanted to have come visit regularly. So yes, we now are the proud renters of an enormous 5br 2700 sqft house. Its over twice the size of our humble 3 little townhouse who's kitchen only had one drawer and no garage.

It didn't take too long to figure out that rents in the area are a much better deal than buying.....and so we sit.....waiting very impatiently for prices to come down.....my husband and mom are tired of listening to me discuss the housing market ....and hence this blog was born.

Serrano in El Dorado Hills

However, first impressions fade quickly. Other than the nice looking architecture of the houses, I am really not too fond of the community. I don't like gated communities that prize conformity above all else. And to top it all off, the park doesn't have a bathroom, which has been a problem for my 3 year old on more than one occasion.

As for the housing situation...it is really ridiculous.......every street is filled with for sale signs. So for all those commenting that the inventory is largely made up of run-down homes .....they are wrong.....there are also tons of overpriced Serrano homes.

Sunday, April 15, 2007

Devil is in the Details

I tend to regularly hit ZipRealty, Zillow, MetrolistMLS and SacBee for my data. I also visit several excellent Sacramento housing blogs that regularly post data. I have them to thank for the care and feeding of my obsession. (I had never even looked at a blog before them!)

http://sacramentolanding.blogspot.com/ as well as http://sacrealstats.blogspot.com/

I'll get to posting some actual data tomorrow.

Wecome to my obsession!

Needless to say.....hubby and I are waiting this one out. In the mean time, I regularly collect statistics and will post them here along with other tidbits and observations. All the data I collect is available publicly on the internet....

I never understood the whole blog thing until now. Prior to my obsession , I thought they were only for people with way too much time on their hands....but now that I have been actively following several, I see the light. All this to say...please be patient, as I am a bit of an amateur.